Investors re-rate Rare Earths and Real Estate beyond the ASX 100 (2019)

Some would say Elon Musk is very driven, but he wouldn’t get out of his driveway let alone to Mars without rare earths to power his Gigafactories, Powerpacks and Roadsters. Tesla shares have rocketed 100-fold since its IPO 10 years ago with its market cap passing US$300bn this month, and along for the ride are rare earth/lithium mining stocks such as Lynas, Orocobre and Mineral Resources. The link between Tesla and these stocks was confirmed by its founder last week in a tweet – it sources its lithium from Australia.

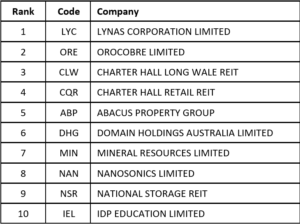

Most major European economies have legislated favourably for electric vehicles (EV) and renewable energy/battery storage and this is reflected in institutional investor sentiment launching these ASX-listed mining companies into the top 10 ‘most improved ASX101-200 stocks’ list from 2018 to 2019 according to research conducted by MarketMeter.

Table 1: Top 10 most improved ASX 101-200 stocks – institutional investor sentiment

Source: MarketMeter

Lynas Corporation was the biggest mover with a 31% surge in its mean score to 6.41 (out of 10) in 2019. Its CFO, Gaudenz Sturzenegger, commented that “We appreciate the strong support of our investors as we build on our track record and unique competitive advantage. Our Lynas 2025 growth initiatives are expected to enable Lynas to meet forecast demand growth and build long term value for our shareholders.”

Jim Copland, Executive Director of Listed Equities at IFM Investors believes “Lynas is one of the most strategically appealing investments in the resource universe, with non-Chinese production of NdPr and other rare earths particularly important given the EV-driven strong demand growth in the medium term. While Lynas has had more than its share of challenges in terms of commissioning in the early days, low commodity prices, balance sheet stress and Malaysian politics, CEO Amanda Lacaze and her team have significantly de-risked the business and are now strongly positioned for growth.”

Institutional investors have clearly re-rated the stock, but while its share price has recovered to around pre-COVID levels, it hasn’t quite enjoyed the Tesla-type trajectory. Omkar Joshi of Opal Capital Management notes that “Lynas has lots of moving parts. For example, it had the Wesfarmers attempted takeover last year and some issues with the Malaysian government – so it has had some challenges. Rare earths are linked to batteries which is a positive theme for Lynas, but what is the outlook for battery materials prices, and are the prices sustainable?”

Mr Joshi suggested “Orocobre is similar to Lynas in that it is linked to the EV and battery theme, which again is a good theme, but how are these companies each individually operating and what’s happening with commodity prices? Lithium prices have been under pressure in recent years so it creates some uncertainty.”

Orocobre is also similar to Lynas in that it has seen a major boost in institutional investor sentiment, scoring 16% higher in 2019 than in the prior year. Its Managing Director and Chief Executive Officer, Martín Pérez de Solay acknowledges the uncertainty Mr Joshi refers to, but sees a positive future underpinned by government stimulus. “While COVID-19 related manufacturing closures have impacted lithium battery/electric vehicle (EV) demand in the short-term, the pandemic has delivered accelerated investment in some jurisdictions which will have medium and long-term benefits. European Governments have expressed a clear intention to utilise electric vehicle investment and support as a platform to stimulate their respective economies. Germany has doubled previous incentives and now provides up to 9,000 Euros for purchasing an EV while France, the United Kingdom and other European countries are all implementing specific programs to support the manufacture and use of EV and hybrid vehicles. Norway is ending the sale of internal combustion engine vehicles by 2025, the Netherlands by 2030, the UK by 2035 and Denmark and France by 2040. In China, subsidisation has grown at the Provincial level delivering a modest improvement in EV sales. Sales could increase further in 2020 with better availability of highly sought-after international brands. In addition, continuing battery cost reductions are likely to be passed on to consumers through lower EV prices.”

While European economic policy and stimulus is undoubtedly a boon for rare earth/lithium mining companies, Tim Buckley, the Director of Energy Finance Studies, Australasia at Institute for Energy Economics & Financial Analysis, shares Omkar Joshi’s caution about the outlook for these commodity prices. Mr Buckley states that “Chinese industry is the dominant strategic player in rare earth and lithium ion mining and processing globally. They dominate the industry, and the downstream use of these commodities. I am very bullish about the sustained volume growth expectations for these commodities – solar modules, EV, batteries and magnet demand are all on a long term secular growth trend, and China is absolutely driving this global energy sector disruption. This is evidenced by China’s production and purchase of 99% of all EV buses globally in 2019 and its May 2020 monthly sales of electric 2-wheel bikes up 45% yoy – the highest monthly total ever for 2-wheeler sales. However, he also notes that China is “primarily driven by non-profit motives i.e. exports, manufacturing, technology dominance and employment, with profits as an afterthought in many cases. This means that they regularly use price deflation as a lever to accelerate volume growth, often driving the commodity prices down to stimulate volume growth. As such, my caution is that volume growth is not a sufficient driver of stock prices, one needs to see profitable volume growth.”

Another player in the lithium ion space, Mineral Resources, saw sentiment improve 8% to 6.35 in 2019. At more than double the market cap of Lynas their share price has been on a gravity defying run for some time only momentarily interrupted by COVID-19. Jim Copland of IFM Investors commented that “Mineral Resources has an enviable long term Total Shareholder Return (TSR). Through its vision and strong execution, it has leveraged its tier one mining service business into material exposures to iron ore and lithium markets. At the same time it has made significant progress in transparency and market communication, which has broadened its investor base, while still being true to its entrepreneurial DNA.”

Bricks and mortar also featured prominently in the Top 10 advancers in investor sentiment over the course of 2019 with Real Estate Investment Trusts: Charter Hall Long WALE REIT, Charter Hall Retail REIT, Abacus Property Group and National Storage REIT along with digital property listing company Domain Holdings recording year on year sentiment growth of 6.2% to 13.5%.

While 2019 saw sentiment improve for property stocks, 2020’s COVID-19 pandemic took some of the gloss off the sector. That said, Julia Forrest, fund manager for Pendal Group, praised Charter Hall Long WALE REIT for not withdrawing earnings guidance. She said that its “strategy to focus on high quality covenants and long leases has insulated them from COVID-related disappointments. We expect that to continue.”

Opal Capital Management’s Omkar Joshi concurs and notes that “Charter Hall has very good management and has done well for a number of years. They need to keep finding good opportunities though, as the value of their retail property assets in particular has been under pressure due to COVID-19. Office property prices have been down a bit too but industrial has been fine, so it comes down to market exposure and finding good opportunities to keep deploying their capital.”

David Harrison, Managing Director and Group CEO of Charter Hall Group noted that “The economic outlook is difficult to predict so investors looking for security of income from real estate should focus on high quality assets leased to defensive, essential services and resilient industries and tenant customers, on long leases which both the Charter Hall Long WALE REIT and Charter Hall Retail REIT offer investors. Assets with short-lease terms and/or poor quality tenant covenants are more susceptible in an environment where security of income is front and centre of mind for investors.”

When it comes to Domain Holdings, Opal Capital’s Omkar Joshi said “Domain has held up pretty well as listings have not been as weak as anticipated. Domain competes with a very strong competitor in REA, but the property market has been reasonably resilient throughout COVID-19 so far.”

Jason Pellegrino, CEO of Domain acknowledged investor sentiment in saying “We deeply appreciate the support of our shareholders and the confidence they are showing in Domain’s long-term strategy. We are focused on our goal to establish a property marketplace that delivers to Domain’s purpose – to inspire confidence for all of life’s property decisions for agents and consumers”.

Rounding out the Top 10 most improved ASX 101-200 stocks in 2019 was IDP Education with a 5.8% improvement in investor sentiment. IDP Education is a global leader in international education services, helping international students study in English speaking countries. The stock was at an all-time high prior to the global pandemic, but the stock price has nearly halved since. Omkar Joshi notes that “IDP Education has had a few disruptions with the decline in international student arrivals due to COVID-19, so there is some uncertainty around their future.”

MarketMeter commences data collection following the FY20 earnings season. The digital investor sentiment platform’s Managing Director, Nick Coles predicts that “the 2020 investor sentiment results will be defined by company responses to COVID 19 – how quickly they adjusted strategy, how clearly they articulated this strategy shift and how well they managed their ESG responsibilities during this time.”

About MarketMeter

MarketMeter is a digital disruptor in the institutional investor sentiment arena – providing corporate subscribers and data providers with an interactive analytics platform to access granular insights across 26 performance categories grouped by Management, ESG, Financials, Strategy and Shareholder Engagement.

MarketMeter’s 2020 research is now open and eligible institutional investors and brokers can score their stocks and access the analytics via this link: https://stockscores.marketmeter.com.au/.

MarketMeter’s institutional investor sentiment research is provided to the Australasian Investor Relations Association (AIRA) to determine its annual Best Practice Investor Relations Awards. AIRA has more than 150 corporate members representing over A$1.2 trillion of market capitalisation, or 80% of the total market value of companies listed on the ASX.

MarketMeter produced the flagship 2019 RI Benchmark and Super Study research reports for the Responsible Investment Association of Australasia (RIAA). RIAA champions responsible investing and a sustainable financial system in Australia and New Zealand to achieve a healthy society, environment and economy. RIAA has over 250 members managing more than $9 trillion in assets globally.

For further information please contact:

0417 697 745

Nicholas.Coles@marketmeter.com.au

0416 079 329

Rebecca.Thompson@marketmeter.com.au

Also published by Boardroom.media

This work is licensed under a Creative Commons Attribution 4.0 International License.

Also published by Boardroom.media

The information on this website is for general information purposes only. It is not intended as legal, financial or investment advice and should not be construed or relied on as such. Before making any commitment of a legal or financial nature you should seek advice from a qualified and registered legal practitioner or financial or investment adviser. No material contained within this website should be construed or relied upon as providing recommendations in relation to any legal or financial product. MarketMeter does not recommend or endorse products and does not receive remuneration based upon investment or other decisions by our email recipients, publications, newsletter or website users.